Boilers on Finance: A Guide to Boiler Financing in 2025

Boilers on finance is a term that refers to a loan that covers the cost of a boiler installation and allows the buyer to not pay for their purchase upfront. Boilers on finance are installed by national, local, and online installers, but the loan funds are provided by a financial institution that acts as the lender in the transaction.

Boiler loans work just like any other loans. Boiler loans’ terms include an Annual Percentage Rate (APR), a repayment period, and often a downpayment. Many boiler financing lenders allow their borrowers to defer their initial payment for a period of up to three months, in a practice that’s known as a “repayment holiday” or an “initial deferment”.

Applying for a boiler loan requires the borrower to undergo a credit check. Borrowers with high credit scores qualify for low APRs and zero-interest loans, whilst those with a poor credit history end up with high APRs or get their financing applications declined.

People who require a loan to cover the costs of boiler replacement are able to find financing deals from national, local, and online installers. The boiler financing terms and conditions differ between boiler installation companies. However, all installers generally offer zero-interest loans as well as APRs that hover around 11%, with repayment terms ranging from 1 to 10 years.

The process of applying to get a boiler on finance differs between boiler installers. However, the procedure is generally straightforward and you do not have to wait long to find out if you’re approved as long as you have the documents to support your credit bureau check handy.

Getting a boiler on finance is generally worth it because the savings made possible by replacing an ageing, or inefficient boiler with a new one outweigh the financing costs.

How does boiler financing work?

Boiler financing works like a bank loan. A financial institution (not the boiler fitter) offers you a loan that covers some, or all, costs of buying and fitting a new boiler. The terms of the loan spell out the following key conditions.

- Annual Percentage Rate (APR): The APR is your cost of borrowing the money to cover the costs of buying and installing a new boiler. The APR is annual, but is generally calculated monthly so as to coincide with your payments. APRs for boiler financing range from 0% to 20% and up.

- Downpayment: The downpayment is the initial deposit you make towards your boiler purchase, with the lender providing the difference in the form of a loan. Downpayment options start at £0, but the more you deposit upfront, the less you have to borrow and the less you’ll pay in interest over time.

- Repayment: Boiler loan repayment terms generally range between 3 and 10 years. The longer your repayment term, the more interest you pay over time.

- Repayment holidays: Some boiler loans allow the borrower to defer their initial repayment 1-3 months from the purchase date. This initial deferment gives you time to rearrange your finances to account for the new monthly expense, and is particularly useful if you need an unplanned, emergency boiler replacement.

- Credit check approval: All boiler financing agreements are conditional on the borrower’s credit check results. You’re not eligible to receive a boiler loan if you do not meet the minimum credit score requirements stipulated by the lender.

Below is an in-depth explanation of the aforementioned boiler financing loan conditions.

What are the APRs for boiler financing?

APRs for boiler financing start at 0% and range to 20% and up. The average APR for boilers on finance is around 10%, but you can easily find rates that are more competitive. Below is a more thorough explanation of what you should expect from boiler loans with different APRs.

0% APR: Interest free boilers

A 0% APR in boiler financing means that you’re getting an interest-free loan to cover your new boiler purchase costs. The lender does not charge any interest with a 0% APR, and all you repay is the principal amount of the loan. However, 0% APR boiler loans come with two major caveats. Firstly, 0% APR loans give you less time to pay off the principal than loans that charge interest. A typical 0% APR boiler loan has a 36-month term, whilst a loan with a 8% APR allows you to repay the funds over the course of 120 months. This discrepancy between the repayment terms stems from the lender’s need to recover their funds quickly if they’re not earning them interest. Conversely, lenders have an incentive to extend the repayment terms on loans that bring in interest. Secondly, 0% APR loans are generally available to prime borrowers only. Prime borrowers have high credit scores, which lenders view as a guarantee against potential defaults. Lenders give preferential boiler financing terms (like 0% APR) to borrowers who pose the lowest default risk.

7-20+% APR: Take up to a decade to pay off your boiler loan

Boiler loans with interest have APRs that range between 7% and 20%+. Lower interest rates are generally available for prime borrowers with good credit scores (650 and up). Conversely, lenders reserve higher APRs for boiler finance applicants with poor credit (650 and down).

Boiler loans with an APR of above 0% come with longer repayment terms, as lenders aren’t in a rush to recover funds that are bringing in interest revenue. For example, a 0% APR boiler loan typically has a repayment period of just 36 months, whilst a 10% APR loan lets the borrower pay off their boiler over 10 years.

The best APR for a boiler finance plan (if you can’t get 0% APR or the short repayment term isn’t suitable for your) hovers around 8% in 2025. An 8% APR boiler loan generally gives you repayment options of 36-120 months. Opting for the shorter repayment terms helps you pay less interest over the course of the loan agreement.

For example, Heatable is an online boiler installer who offer financing with all their new boiler deals. Heatable’s APR and repayment options are as follows.

- 0% APR with a 1, 2, 3, or 4-year repayment term

- 11.9% APR with a 3, 5, or 10-year repayment term

You can see which of Heatable’s new boiler deals are suitable for your home (and get your financing options on your screen now) by filling in this anonymous property questionnaire.

What if the APR is too high?

If the APR is too high (above 13%), consider a loan from a high street bank. In most cases, a high street bank should be able to get you a loan with a 10% APR.

What is the minimum deposit to get a new boiler on finance?

There is no minimum deposit to get a new boiler on finance, and the maximum deposit is generally 50% of the boiler installation costs. The majority of lenders don’t require a deposit as a precondition of approving a boiler loan. However, the more you pay down upfront, the less interest you’ll owe over the loan’s term.

Finance your boiler now with £0 down

Most boiler installers who offer boiler financing have £0 down loan options — even with a 0% APR. However, you should have a sufficiently blemish-free borrowing history to qualify for a £0, 0% APR boiler loan. Just remember that financing is a balance between time, principal, and interest, so £0, 0% APR loans generally come with short repayment periods, such as 24 months. So, if you want to pay nothing upfront, and don’t feel like paying interest, you can still qualify for financing — just as long as you repay the entire amount within 24 months. You have the option of settling for a higher APR and extending the term beyond the lender’s shortest period.

Pay a downpayment and finance the rest

Paying a downpayment on a boiler loan is a good practice for two reasons. Firstly, the lower your principal (i.e. the less you borrow), the less the lender will collect in interest payments. For example, Heatable recommend paying a deposit of at least 25% when applying for boiler financing, as doing so helps you pay off the loan with less interest. Secondly, making a significant downpayment (at least 25%) gives lenders a more favourable view of your application if your credit history is poor.

APR is still a key part of the boiler finance formula even if you make a substantial downpayment. Boiler loans have a short repayment period with an APR of 0%, whether you’ve paid anything down or not. So, you must find the balance between the desired APR and the length of repayment even if you’re making a downpayment. What this APR-repayment balance is is entirely up to you, but essentially you have two options:

- Pay more interest and repay the loan at a leisurely pace.

- Pay less interest with larger principal payments for a shorter time.

What are the repayment terms for financing boilers?

The repayment terms for financing boilers differ depending on who the lender is and what sort of finance deals are available. Most boiler finance offer repayment terms of 36-120 months. When getting boiler finance, plan out a monthly repayment amount that is viable and see which option is the best fit.

Remember that when you get boiler finance, you repay the boiler cost and interest. The longer the repayment terms the higher the total cost.

Boiler finance repayment holidays

Boiler finance repayment holidays allow borrowers to defer their initial boiler loan repayment by up to three months. Repayment holidays are a useful option if your boiler broke down suddenly and you weren’t ready to add the additional expense of loan repayment to your monthly budget. The ability to defer the first repayment gives you time to tweak your finances to account for the new, unexpected line item in your budget.

Can you get a boiler on finance if you have bad credit?

Yes, you can get a boiler on finance if you have bad credit. You shouldn’t have to worry about passing your boiler financing credit check with a slightly tarnished credit history. Generally, you’ll pass the check and qualify for financing if you have no County Court Judgements (CCJs) or Individual Voluntary Arrangements (IVAs) registered in the past five years.

However, a poor credit history, or one marred with recent CCJs and IVAs precludes you from getting prime loans, i.e. loans with attractive APRs. Generally, a poor credit score (below 600) means you’ll have to settle for a high 15%+ APR from a subprime lender. Essentially, you pay more interest in exchange for being afforded a boiler finance loan while presenting the lender with a risk of default. The premium subprime borrowers pay on their loans acts as a cushion for the lender to cover losses when some of the borrowers default.

The best boiler installers work with a wide array of lenders, and are thus able to offer boilers on finance to customers with excellent and poor credit scores alike. For example, Heatable work with both prime and subprime lenders to ensure that as many of their customers as possible are eligible for financing, regardless of credit history. You can see if you’ll qualify for boiler financing through Heatable by filling in and submitting this questionnaire.

No Fuss.

Get your fixed online price for a Which? approved boiler, installation included.

How to get a boiler without financing?

You have two core options to get a boiler without financing.

- Pay up front with savings: The easiest way to get a boiler without financing is to buy the boiler outright before installation. One transaction and everything is taken care of.

- Borrow from family: Borrowing money from family is another viable option. It allows you to get the boiler you need and spread the payments over time without financing and having to worry about interest.

Where can I find deals for boilers on finance?

You can find deals for boilers on finance by inquiring with national, local, and online boiler installers. Below, we discuss boiler financing deals from national, local, and online boiler installers.

Getting boilers on finance from national companies

National companies offer financing options for the boilers they install, but some have better deals than others. Below, we take a look at some of the current boiler financing deals from British Gas and E.On, two of Britain’s “Big Six” energy and heating companies and major nationwide boiler installers.

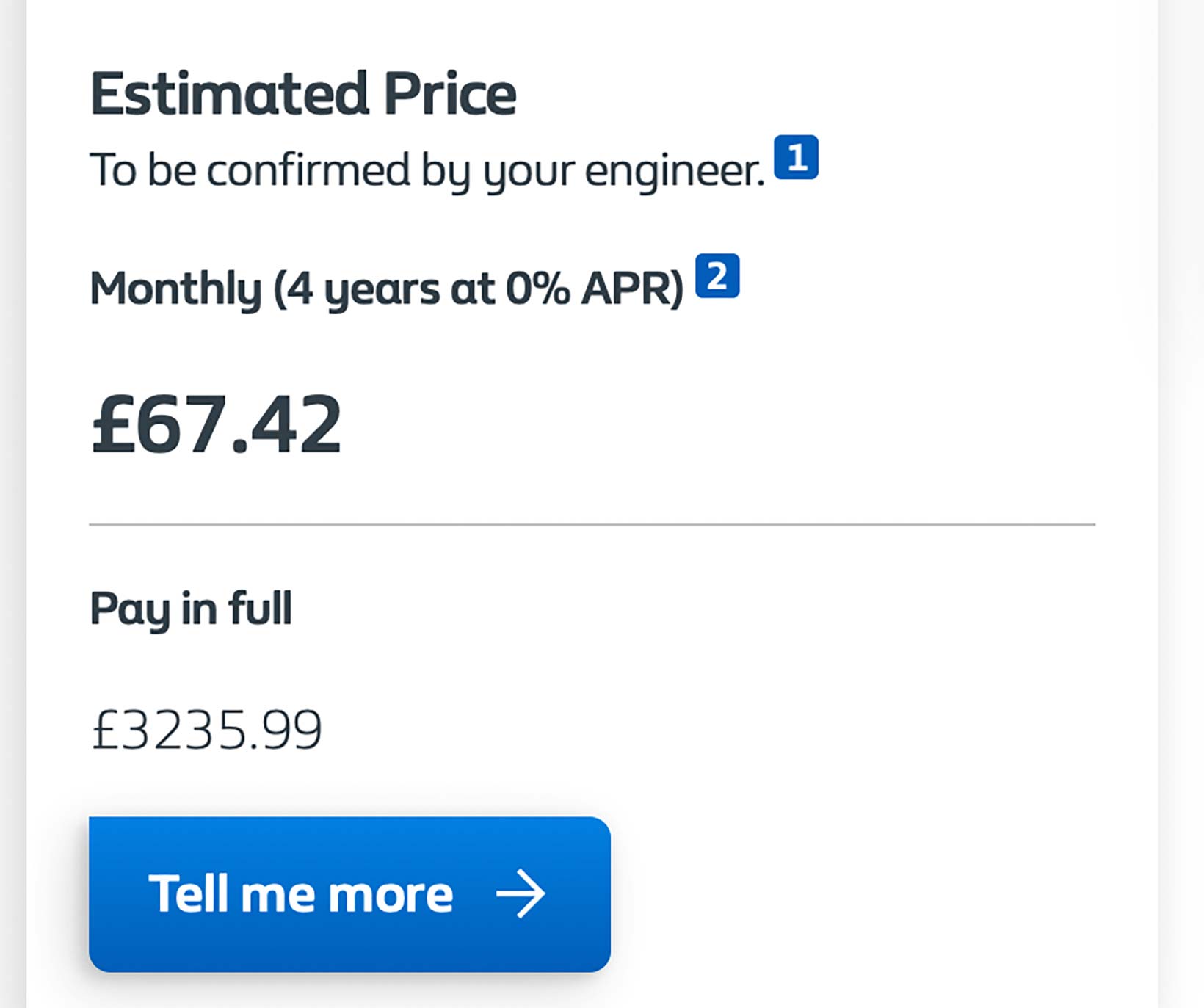

British Gas boilers on finance deals

British Gas offer a interest-free boiler loans with a 4-year repayment term and £0 down, an excellent deal if you have good credit and don’t mind adding a £60+ expense to your monthly budget. However, this deal is not suitable for you if you’d rather make smaller payments over a longer period, or cannot qualify for 0% APR because of a poor credit score. Below is a screenshot of a British Gas boiler financing quote for a boiler that would cost £3,235.99 to install if you pay in full.

E.On boiler financing deals

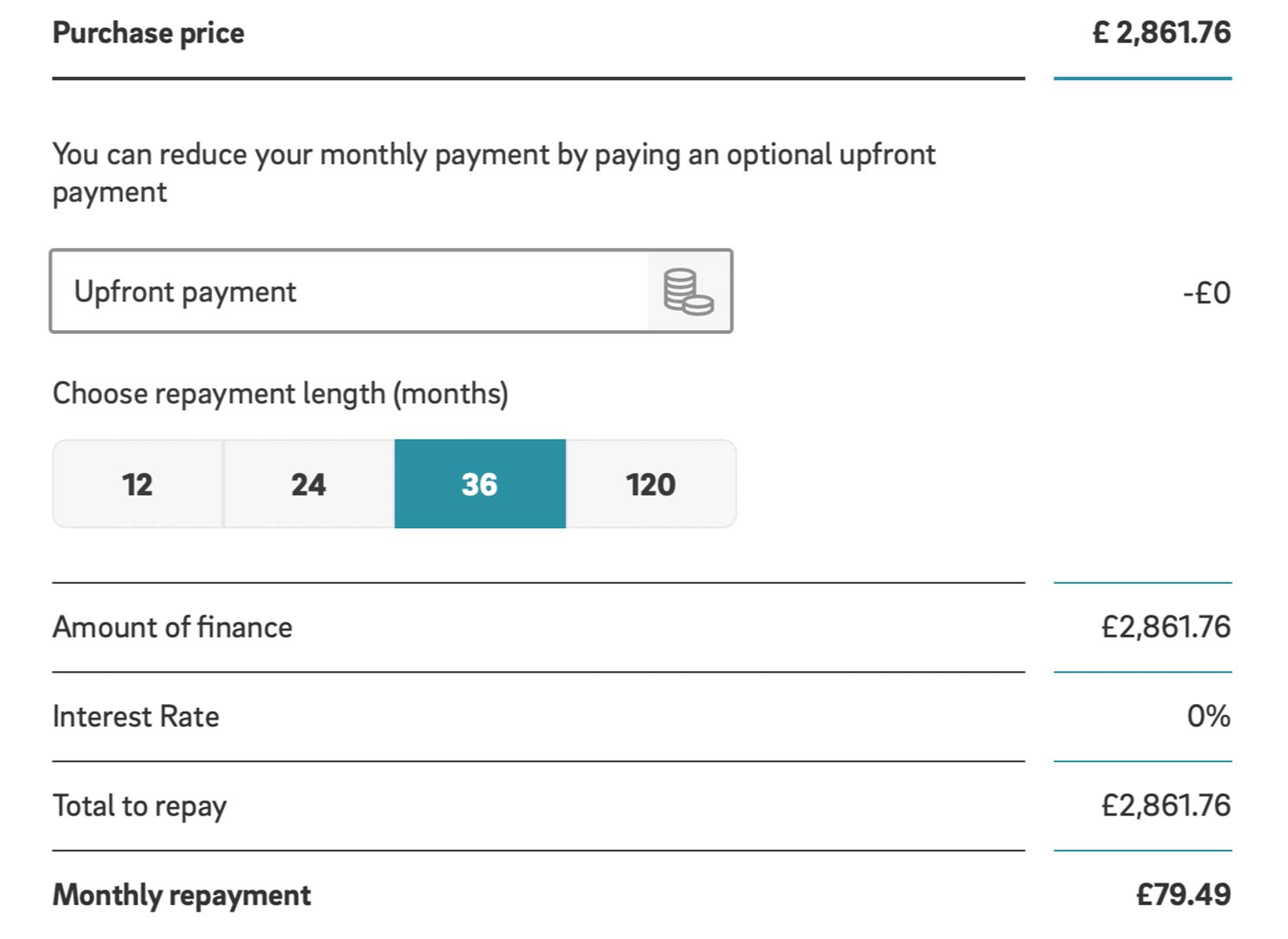

E.On’s boiler financing options are more flexible than those of British Gas. E.On allows you to tweak the following two boiler loan parameters to your liking.

- Downpayment: E.On lets you make a downpayment of up to 50% of the cost of the boiler installation.

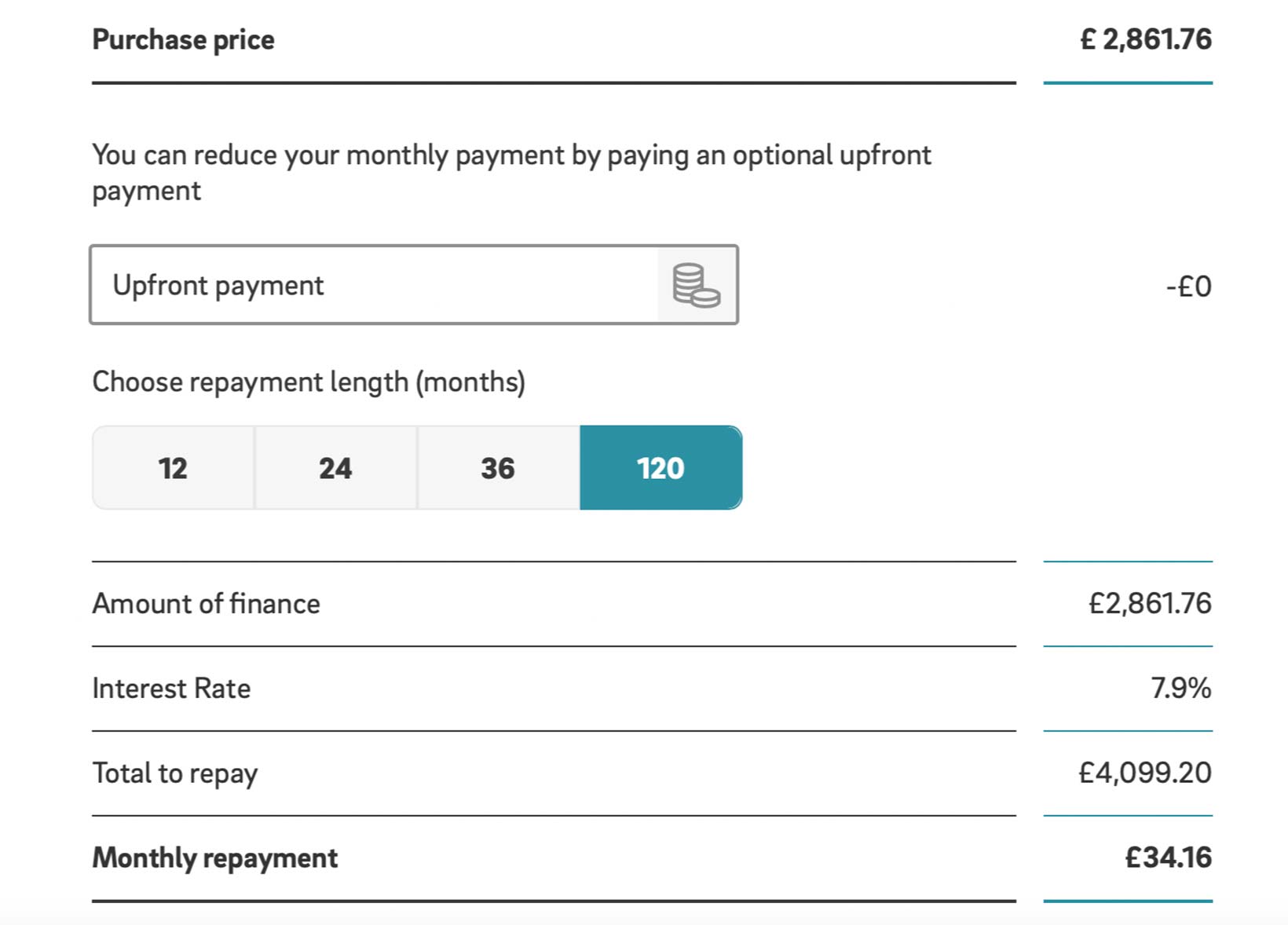

- Repayment lengths: You’re able to choose from 12, 24, 36, and 120-month repayment terms. The APR remains 0% for 12, 24, and 36-month terms, and goes up to 7.9% for the 120-month term.

The following is a screenshot of a £2,861.76 boiler loan with £0 down, 0% APR, and a repayment term of 36 months.

And below is a screenshot of the same boiler on finance with a 120-month repayment term. Notice that the APR is now no longer 0% – it’s 7.9%, and consequently, the total amount to repay is £1,237 higher than the principal alone. £1,237 is how much you’ll pay in interest with an APR of 7.9% over a 10-year period.

Both deals from E.On are fair and suitable for different budgets. However, you need to have a good-to-excellent credit rating to qualify for boiler financing on such favourable terms. You won’t be able to get an APR of 7.9%, let alone a zero-interest loan, if your credit score is poor.

Getting boilers on finance from local installers

Most local boiler installers offer boiler installations on finance. However, researching their financing options is more difficult than with national companies. Local boiler fitters have smaller marketing budgets and simpler websites that are often left without crucial updates about current financing offers. You’ll have to get in touch with a local boiler company to see what boiler financing deals they offer at the moment (find up to three local installers here).

Getting boilers on finance from online installation companies

Online boiler installers often have flexible financing terms, but the exact conditions vary from one company to the next. Below is a summary of the 2025 boiler finance deals from three of the UK’s most prominent online boiler fitters: Heatable, Boxt, and Warmzilla.

Heatable boiler financing offers

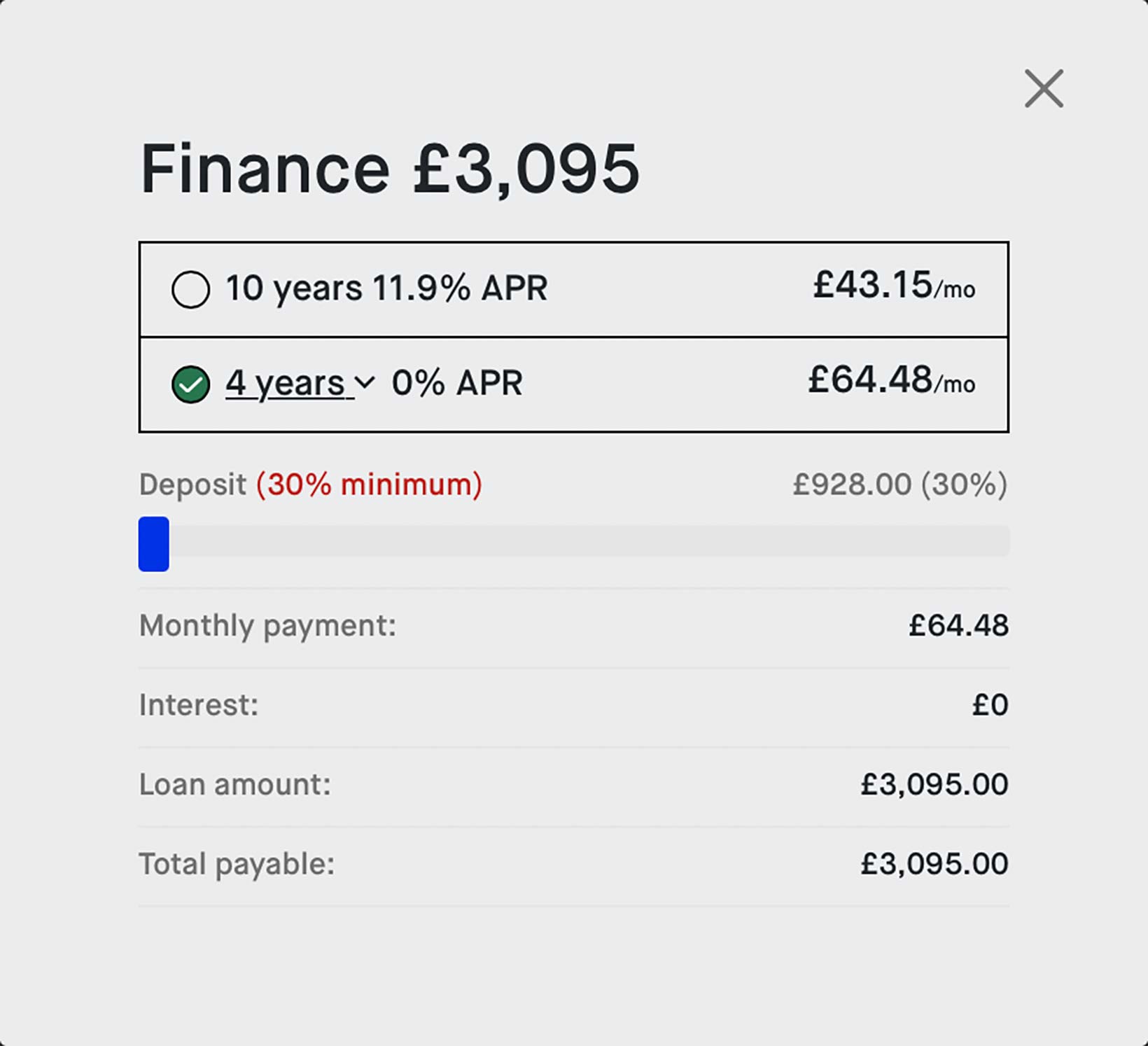

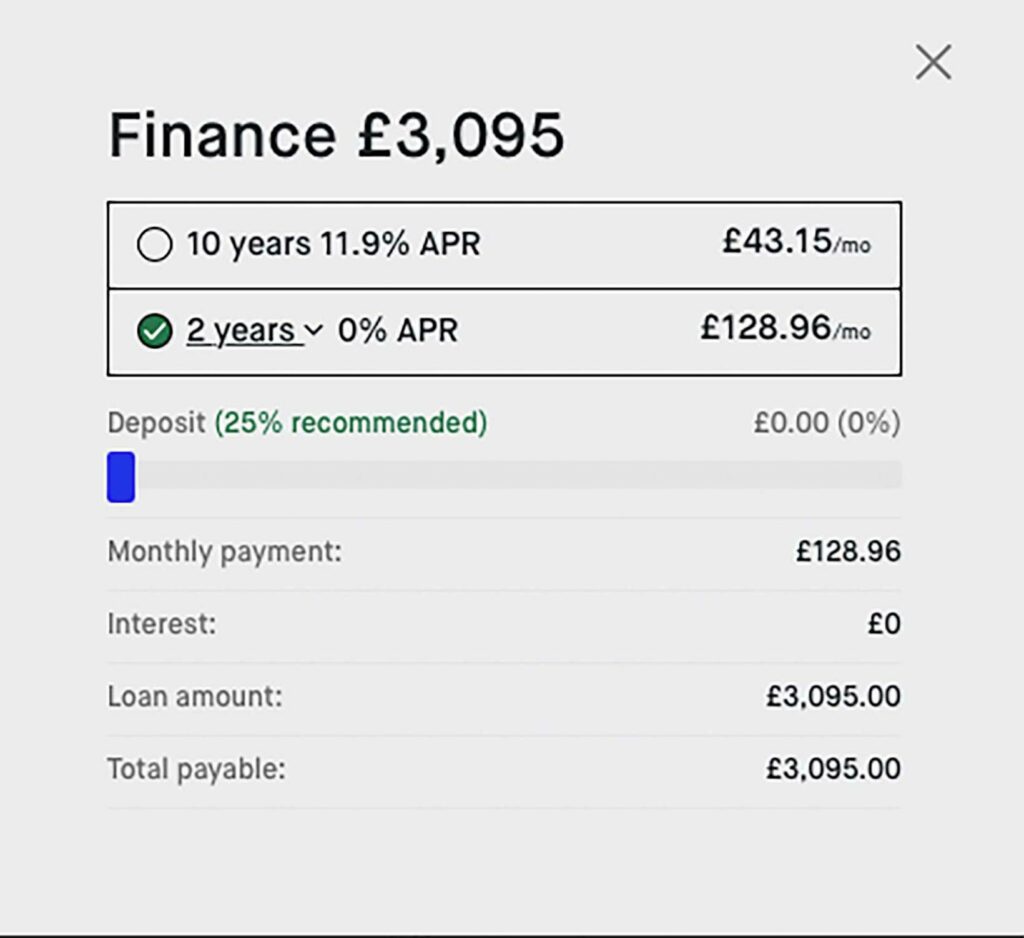

Heatable have some of the most flexible boiler finance options of all online boiler fitters. Heatable give you the option of repaying your loan over a 1, 2, 3, 4, 5, or 10-year term, with 0% and 11.9% APR options. 0% APR is available on 1, 2, 3, and 4-year terms, whilst 11.9% APR is available on 3, 5, and 10-year terms. Below is a screenshot of Heatable’s financing offer for a £3,095 boiler installation on a 4-year repayment term with 0% APR (30% downpayment required).

And below is the same boiler with a 2-year financing term and 0% APR (no down payment required).

You can check out Heatable’s new boiler quotes and financing offers yourself by filling in this clickable form.

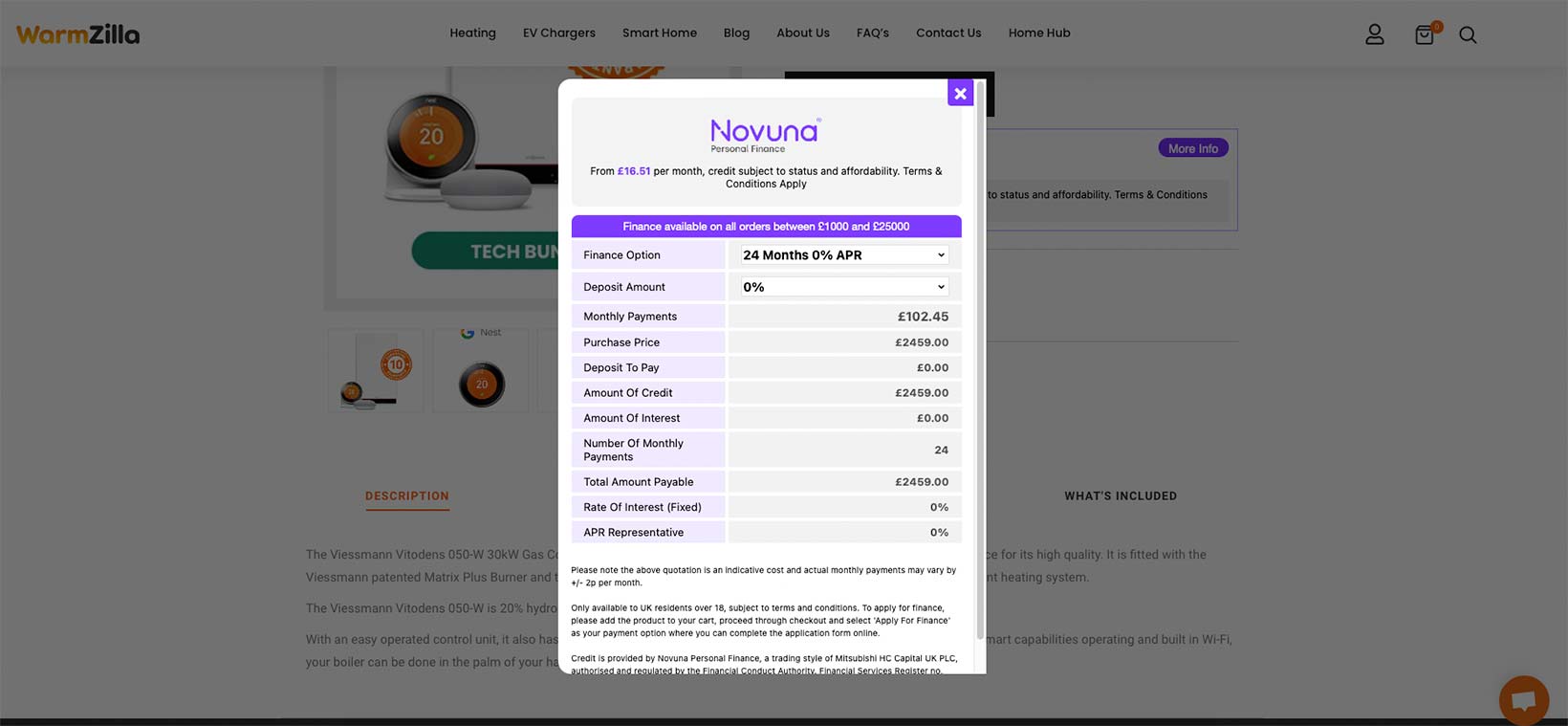

Warmzilla boilers on finance deals

Warmzilla’s boiler loans come with flexible terms and two APRs from which to choose. Warmzilla offers boiler financing terms of 1, 2, 3, 4, 5, and 10 years, just like Heatable. The available APRs are 0% for 1 and 2-year terms and 10.9% for 3-10 year terms. Unlike Heatable, 3 and 4-year boiler loans are not eligible for a 0% APR.

The following is a screenshot of Warmzilla’s 2-year, 0% APR finance offer for a boiler that costs £2459.00 to purchase and fit.

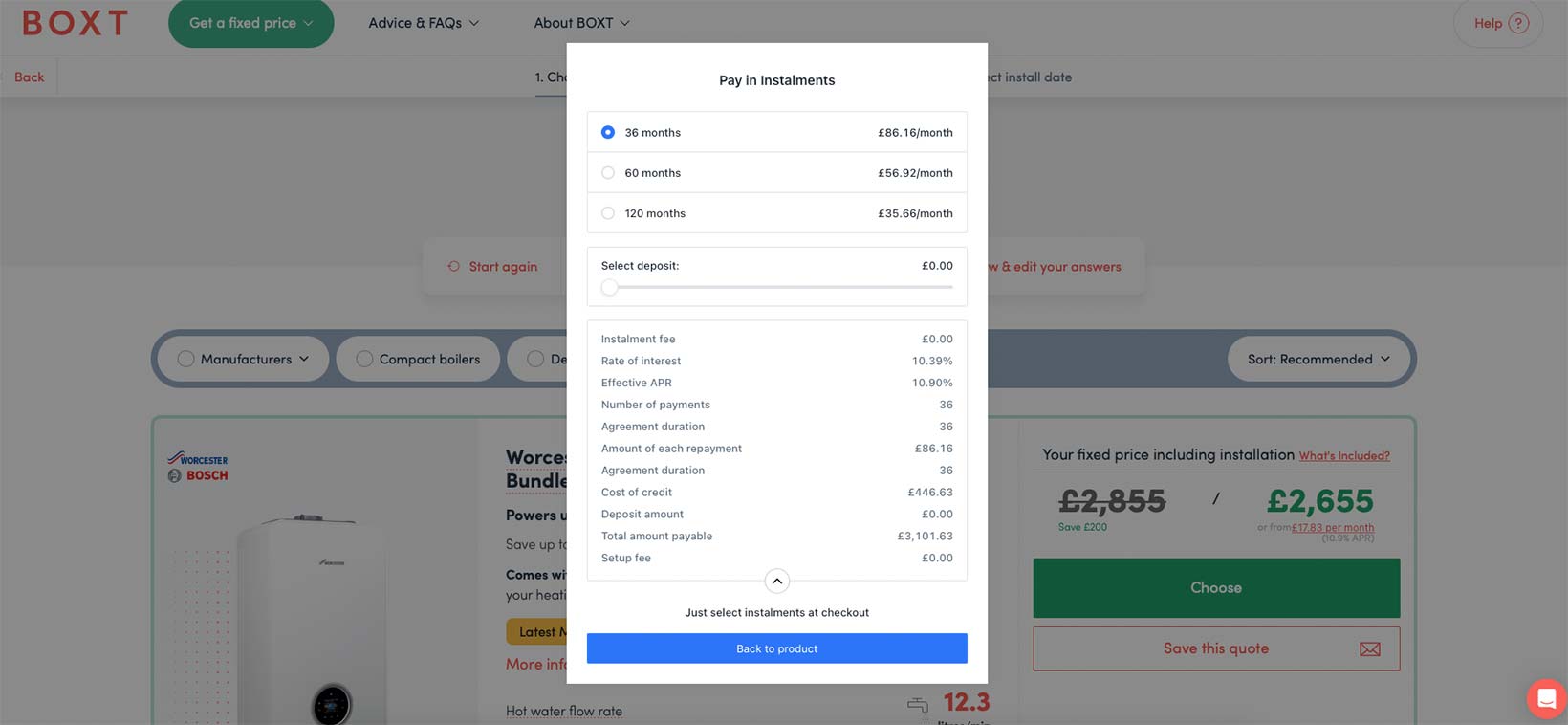

Boxt offers for boiler finance

Boxt offers three boiler loan repayment terms, 3 years, 5 years, and 10 years, and a single APR: 10.9%. There’s no 0% APR offer, nor is it possible to pay off the loan faster if that’s what you’d prefer if you install your boiler through Boxt. See for yourself in this screenshot of Boxt financing options for a boiler that costs £2,655 to install.

How do I apply for boiler financing?

You apply for boiler financing by requesting instalment payments from your boiler installer. Most companies that install boilers have an online application tool that lets you input financing parameters, such as the desired APR, repayment terms, and initial deposit. The application tools vary between boiler installers, but you’ll have to follow the five basic steps below to apply for a boiler loan regardless of who the fitter is.

- Confirm you’re eligible for finance: Prepare documents that allow the lender to conduct a credit check and confirm your eligibility for the loan. You have to be ready for a credit check regardless of who your installer is, so this is the first step in your boiler finance application.

- Choose the boiler installer: Take your pick from one of the national, local, or online companies offering boiler installations in the UK.

- Choose the boiler you want: Consider the following factors when choosing the most suitable boiler for your household.

- Property size: A small two bed mid-terrace house requires a boiler with a smaller output than a five bed detached property.

- Hot water demand: A home with a single bathroom can get away with a smaller output boiler than one with a toilet, a bathroom, and an en-suite.

- Brand: Certain boiler brands are known for their reliability, performance, and aftercare. For example, you can’t go wrong with Worcester, Vaillant, Viessmann, or Baxi. However, these premium brands are quite pricey. So, midrange alternatives such as Ideal and Alpha are cost-effective, worthwhile options if you’re on a budget.

- Warranty: A manufacturer’s warranty speaks volumes about the company’s confidence in their product. For example, a 2-year boiler warranty means that the manufacturer expects their appliance to require repairs after two years of service. Meanwhile, a 10-year warranty means that the boiler manufacturer expects their product to last a decade before requiring frequent repairs. Boilers with longer warranties are generally a bit more expensive than those with short warranties.

- Choose the finance plan you need: There are several finance options available, including different repayment periods, deposit options, and APRs. Select the option that best fits your budget.

- Submit your application: Submit your application and wait for the prompt to upload the requisite identification needed to perform a credit check. Your approval should come within a day or so (often earlier).

FAQs about boilers on finance

Below are five frequently asked questions about financing boilers.

Is it worth getting a boiler on finance?

Yes, it is worth getting a boiler on finance. Paying for a boiler upfront is the best option, but for many it is not viable, so boiler finance is the next best thing. Getting a new boiler on finance may be your only choice if your boiler has stopped working suddenly, but it’s also a cost-effective way of replacing an old boiler that’s breaking down often. Obtaining a boiler on finance means an additional monthly expense, but replacing your old boiler can save you more money than the costs of financing.

Below are six reasons getting a boiler on finance is worth it.

- Energy efficiency: A new boiler is more efficient. Replacing an old boiler with a new one saves up to £840 a year on energy bills, according to the Energy Saving Trust. That’s far more than you’ll pay in interest in a single year (unless you’ve got a £15,000+ biomass boiler).

- Cost of repairs: An old boiler can be costly to repair when something goes wrong. Consider getting a replacement boiler on finance if the interest you’ll pay is lower than the projected (or historical) annual cost of boiler repairs.

- Better water temperature: As boilers age, they become less consistent with the water temperature they produce. Getting a new boiler on finance means more consistent water pressure and temperature.

- New warranty: Getting a new boiler will also mean a new warranty covering you for any repairs or breakdowns during the warranty period.

- Get the boiler you need: Getting a boiler on finance means spreading the costs over a number of months or even years. This means you can budget accordingly and look for the boiler that is right for your needs, rather than being limited by your immediate spending potential.

- Extras: Many boiler finance companies will run promotions and offers to tempt people to finance a new boiler through them. This could be anything from free services every year for the life of warranty to money back or additional boiler related extras.

Can you pay monthly for a new boiler?

Yes, you can pay monthly for a new boiler. Most boiler providers offer various forms of payment schemes and boiler finance options.

There are 3 factors that impact how much you can pay monthly for a new boiler.

- Deposit: The amount of money you are able to pay upfront will impact the likelihood of being able to pay monthly for a new boiler. A sizable deposit also impacts the amount you need to pay each month.

- Installation company: Most installers offer payment schemes and boiler financing options, but there are some that do not have those options. For example, many smaller local tradespeople do not have partnerships with lenders and are thus unable to offer boiler financing.

- Credit rating: Paying monthly for a boiler means taking out a boiler finance plan. The applicant’s credit rating will impact whether they are approved or not, and also the interest rate offered upon a successful application.

How to afford a new boiler?

Below are the four ways to afford a new boiler.

- Get a boiler on finance: Getting a boiler on finance is a common way for people to afford a new boiler. Rather than paying thousands of pounds up front, the cost is spread out over even monthly instalments.

- Make full upfront payment: Paying for a boiler in full is a valid option for some. There are a range of boilers to suit all news and budgets. If finance is not possible, buying a budget boiler outright is a viable alternative.

- Family: Borrowing money from family is never fun, but it is a way to afford a new boiler. Family’s generosity makes it easier to afford a new boiler whether you borrow the full amount or just a sizeable deposit.

- Applying for a free boiler grant: Some people qualify for a free boiler under the Energy Companies Obligation scheme. Those that meet the qualifying criteria can apply to replace broken gas boilers.

Can I get a new boiler on universal credit?

Yes, you can get a new boiler on Universal Credit. The new gas boiler would be funded as part of the Energy Companies Obligation (ECO) scheme. However, not everybody who received Universal Credit will be given a brand new boiler. For example, people who live in social housing are not eligible for a new boiler under the ECO scheme.

Currently, the ECO scheme is only available for the replacement and installation of gas boilers.

How can I get a free boiler in the UK?

You can get a free boiler in the UK by meeting the qualifying criteria for a boiler grant under the ECO scheme and its Home Heating Cost Reduction Obligation (HHCRO). Below are the qualifying requirements for the ECO boiler grant.

- You’re a homeowner or private tenant.

- Your boiler is broken.

- Your boiler is over 10 years old.

- You receive one of the following qualifying benefits.

- Pension Credit Guarantee Credit Element

- Income-related Employment and Support Allowance (ESA)

- Income-based Jobseeker’s Allowance (JSA)

- Income Support

- Working Tax Credits

- Child Tax Credits

- Armed Forces Independence Payment (AFIP)

- Attendance Allowance

- Carer’s Allowance

- Disability Living Allowance (DLA)

- Severe Disablement Allowance

- War Pensions Mobility Supplement

- Industrial Injuries Disablement Benefit

- Personal Independence Payment (PIP)

- Constant Attendance Allowance

- Child Benefit

How to pay monthly for boilers on finance

To pay monthly for boilers on finance you need to shop around to find the right pricing option for you. Click here to get a free boiler finance quote from Heatable on your screen in less than a minute.

Getting a boiler on finance is a viable suggestion for many people as paying for a boiler upfront is expensive. If you’ve had some quotes to finance a boiler but feel they are too high, leave a comment below and we will get back to you.

This was an informative and reassuring read. It was easier to understand than many others I have looked at and was clear and helpful to someone like me, who isn’t at all familiar with the subject matter. It helped med to decide what to do, and I heartily recommend it.