Best Energy Comparison Sites: Guide to Switching Energy Suppliers in the UK

Do you fancy the thought of switching your energy supplier, but don’t know where to start?

In this article, we’ll talk about the benefits, risks, and best means of switching energy suppliers. Read on to find out the easiest way to shave precious money off your energy bills.

Why should I compare energy deals?

The UK energy market has been seeing far more competition since it was first deregulated in the 90s. Yet, over 70% of domestic consumers still stick by one of the ‘Big 6’ suppliers, despite being free to choose between over 50 other companies, most of which are vastly cheaper.

We’ve said it before, and we’ll say it once more: unlike many other businesses, energy companies do not incentivise loyalty. The longer you stay with one, the less you’ll save. Even with robust government measures, like the cap on standard variable tariffs, you can still find better savings by changing your supplier.

And we don’t mean changing them once, say when you move to a new home. No. You’ll only pay a reasonably priced energy tariff if you keep your eye on the market and switch often.

How much can I save by switching suppliers?

That depends on a few factors, such as:

- your postcode – some regions pay well below the average for electricity, and others for gas

- your energy consumption

- your consent to online billing – most value deals come with paperless accounts

That said, let’s look at an example. Our benchmark will be a standard tariff from one of the ‘Big 6’, dual fuel (gas and electricity from the same guys), in a random London postcode, with an assumed annual consumption of 2,900 kWh and 12,000 kWh for electricity and gas, respectively. We will use the Citizen’s Advice tool to compare this tariff to a locally available deal from one of the smaller operators.

‘BIG 6’ STANDARD TARIFF

Energy Plan from E.ON

- Estimated annual bill: £1,046

- Tariff type: variable

- Electricity unit rate: 16.96p. per kWh

- Electricity standing charge: 23.72p. per day

- Gas unit rate: 3.104p. per kWh

- Gas standing charge: 26.07p. per day

- Exit fees: none

Did you see the standing charge? You pay 50 pence per day just for the pleasure of also paying inflated unit rates. It’s a good thing you can leave this tariff for free. Now, let’s see what the competition has to offer.

SMALLER SUPPLIER TARIFF

GNE Exclusive Green 12 Month Fix V9

- Estimated annual bill: £791

- Tariff type: fixed

- Electricity unit rate: 12.905p. per kWh

- Electricity standing charge: 17.86p. per day

- Gas unit rate: 2.426p. per kWh

- Gas standing charge: 20.58p. per day

- Exit fees: £25 per fuel if you cancel before the term’s end.

So, if you ditched E.ON’s standard variable tariff, and swapped it for Green Network Energy’s 12-month fixed deal, you could shave £255 of your yearly bill. And you wouldn’t be switching to some hipster startup either.

Green Network Energy’s been around since the turn of the century, has over 1 million clients in the UK and Italy and recently got a gas and power license in France.

But of course, signing up for a small, independent supplier’s tariff, low as it is, may be a worrisome thing. And rest assured, the ‘Big 6’ bank on your reluctance to chance it with a less-established company. But while such risk-aversion is entirely natural, we’ll try to dispel your fears in the next section, so you can switch and save without concern.

What are the risks of switching suppliers?

It’s a common perception that lesser-known suppliers are likely to fail. That’s why the 6 energy giants still control three-quarters of the market, knowing very well that long-time customers are unlikely to abandon them. That’s why their prices are sky-high. The demand these companies continue to enjoy stems in part from the consumers’ fear of waking up to darkness and cold radiators.

And these fears are not unfounded. Since the autumn of 2018, 12 independent energy providers have shut their doors. So one’s not wrong to ask: ‘what happens when my cheap, new supplier goes bust?’

Luckily, Ofgem, the energy regulator, found themselves asking the same thing a while back. So they scratched their heads and decided that failed suppliers are to be replaced, promptly and without fanfare, until the customer can find a stable substitute. No power cuts, no immersion heaters, your electricity and gas keep flowing, oblivious to what’s unfolding backstage.

The only thing Ofgem cannot guarantee you is that your replacement tariff will be cheaper, or at least cost the same. But there are simple ways for you to always stay on the cheapest tariff, even as your suppliers fold; and we’ll get to it shortly.

How can I compare energy deals?

Giving up a tried-and-true, albeit expensive energy provider, is not the only factor that hinders customers from switching. Some people simply do not understand how to do it. Others feel that all the trouble’s not worth the meagre savings.

So, let’s talk about switching and comparison. There are several means for you to browse energy deals and switch. We’ll start with the simplest, least partial, but also least functional comparison tool.

Compare manually via Citizens Advice

Citizens Advice comprises a network of charities from all corners of the UK that offer free, private advice to consumers, regarding legal, financial, and other matters. The service emerged shortly before the outbreak of World War II and has served the UK since. Citizens Advice prides itself on these 4 tenets:

- free service

- confidentiality

- impartiality

- independence

They also boast a powerful price comparison tool. With its aid, you can handily leaf through hundreds of energy deals in your postcode, and weigh them against your current arrangement. If you wish to make a switch, though, you’ll have to start the process yourself, as Citizens Advice cannot help you change providers. But even with this limited functionality, Citizens Advice can give you a clear-cut picture of potential savings.

Pros of using Citizens Advice

- the service is impartial

- the comparison tool can access the wide market without limitations

- it doesn’t cost a penny to use

- it’s remarkably simple

- you see a wide array of tariff details, including all the fine print

Cons of using Citizens Advice

- the service will not perform a switch on your behalf; you must do so yourself

- Citizens Advice may show tariffs that are exclusive to Price Comparison Sites, and which you may not be able to access on your own

- you must initiate comparisons manually; there’s no automatic ‘radar’ that detects new, cheaper deals

To summarise: Citizens Advice offers a convenient ‘peek’ into the energy market. You see what’s out there with no bias or embellishments. That said, the switching process is totally on you.

Price Comparison Websites

The earliest incarnations of these services emerged shortly after the energy market deregulation and multiplied swiftly in the past 2 decades.

Today, price comparison sites are a splendid resource for customers who are fed up with monstrous energy costs and need help to switch. These sites take it a stride further than Citizens Advice. Not only do their comparison tools show you a range of tariff options, but they also execute the swapping process on your behalf. In most cases, all it takes is 60 seconds for you to get an accurate tariff quote, and another 15 minutes to start the swap.

But these services come with a notable downside. Like every business out there, price comparison sites need to earn a living. They do so by charging a commission fee to the supplier of your choice once you’ve applied for a switch. It’s only fair that the middleman should get his cut. That said, price comparison sites have these arrangements with a limited number of suppliers. Some liaise with over 40 suppliers, while others work with less than 10. So the range of tariffs you can switch to is constrained by the site’s commercial relationships with energy companies.

Pros of using price comparison sites

- price comparison sites help you find tariffs and execute the provider swap for you

- they’re free to use

- like Citizens Advice, price comparison sites have a simple, user-friendly interface

- you’ll see all the terms and conditions before you make a switch

Cons of using price comparison sites

- price comparison sites only switch you to suppliers with whom they have a commercial agreement, so you may lose access to hundreds of tariffs;

- most such sites will not switch you automatically when better tariffs come up; you have to scan the market yourself regularly to stay on top of emerging deals

Are Price Comparison Sites Worth it?

There’s no question that comparison sites offer an invaluable service. Despite their limitations, you’ll still save money. To this end, price comparison sites may be a good fit for you if you’d like to retain complete control over when, and how you switch your tariffs, even if it means losing out on cheaper deals and saving less.

What is the best way to compare and switch energy providers?

In the past half-decade, a new type of comparison service has emerged. Still somewhat new to the market, auto-switching sites kick things up yet another notch, and tackle the 2 principal constraints of price comparison sites. Currently, they offer the best way to compare and switch energy suppliers.

HERE IS HOW THEY WORK

Unlike comparison sites, which allow you to perform a onetime supplier change, auto-switchers offer you a membership. On enrollment, the service finds a cheaper alternative to your existing tariff. These sites rely on algorithms that factor in your postcode, annual use, and certain preferences when to locate a deal that fits your needs. After the initial supplier swap, the service keeps on switching you to better tariffs as they surface.

The entire process, from combing through the energy market to cancelling your existing plan, to signing you up for the replacement, is automated.

Sounds brilliant, doesn’t it? You may wonder now, what’s the catch? How do these auto-switching services make money?

Well, some still rely on supplier commissions, much like price comparison sites. Others levy a membership fee. Others yet offer both free and paid plans.

Below, we’ll talk about one of each. The 3 auto-switching sites we’ve picked are the most trusted, highest-rated services in the UK. Read on to see which one would fit you best.

What are the best energy comparison sites?

1. Look After My Bills

If you follow BBC’s Dragon’s Den, you would have seen Will Hodson and Henry de Zoete launching Look After My Bills with that whopping £120,000 investment. If you dig a bit deeper, you’ll find that the pair share a passion for disrupting the heavily monopolised energy market. Before establishing this company, both have worked on ‘The Big Deal’, an undertaking that allowed its members to negotiate tariffs collectively with utility suppliers. Now, their service offers free, automated energy switching to consumers across the UK.

How does Look After My Bills work?

Signing up is a breeze. You enter your postcode and email to register. Then, the service asks for your current supplier and tariff info, and a few personal preferences, which help them set a benchmark in their tariff scan. The whole thing takes 2 minutes of your time and certainly doesn’t require an IT degree from Oxford.

Next, you’ll see what deal they’ve found you, and the switch will go ahead. Unlike price comparison websites, Look After My Bills does not show you a range of deals, which you then must decipher. They simply display the tariff that their algorithm picks based on your survey.

That’s it. You needn’t do much else, as Look After My Bills will go on hunting the market for deals. They’ll switch you again, if:

- your fixed-term deal is ending

- 3 months after the start of a variable tariff, if there’s a new deal that will save you £50 or more on a dual fuel switch, £25 on an electricity-only switch, or £15 on a prepayment meter switch

How does Look After My Bills make money?

Look After My Bills does not charge you a penny to be their member. Like a price comparison site, this auto-switcher makes their money from commission arrangements with suppliers. As we’ve mentioned before, relying on commercial arrangements leads to a narrower range of tariffs they can offer you.

What do customers think of Look After My Bills?

Since they’ve opened doors, Look After My Bills have rallied a 200,000-strong customer base. Over 17,000 of these folks have left Trustpilot reviews, 85% of which rate the service as ‘excellent’. The firm’s overall rating is a mighty 4.6 out of 5.

How much would I save with Look After My Bills?

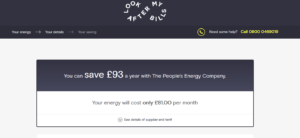

The answer to this varies greatly depending on where you live and who supplies your energy before the switch. For illustrative purposes, we’ve used a London postcode, and assumed an annual usage of 12,000 kWh of gas and 2,900 kWh of electricity, with EDF’s standard variable tariff as your current deal. Based on these inputs, Look After My Bills is offering us savings of £93 per year, with a switch to The People’s Energy Company.

To find out how much you can save, simply fill out this quick survey and you’ll have the quote in less than 2 minutes.

What are the pros of Look After My Bills?

- it’s free

- the interface is simple and user-friendly

- the service switches your tariffs automatically

- 99% of customers end up with savings after their first switch

What are the cons of using Look After My Bills?

- your tariff options, and savings, are limited to those suppliers who pay commission fees to Look After My Bills

2. Flipper

Editor’s update: Flipper has unfortunately shut their doors for good.

Founded in 2016, Flipper touts its comparison algorithm, Joules, as their key to intelligent, effortless switching. What sets them apart from Look After My Bills, is the frequency of automated switching, and broader access to the wide market.

How does Flipper work?

Like with other similar services, you start the journey by creating an account and entering your location. For best results, Flipper asks for your actual gas and electricity usage, which they can obtain from your online energy account or a PDF scan of your paper bill. This precision allows Joules to factor in your actual consumption when finding you a new deal.

Next, Joules sifts through fitting deals available in your postcode, and weighs them against 6 essential requirements:

- you’ll be on the new tariff within 35 days, without home visits by the supplier’s reps

- you get full tariff details, and a 14-day cooling-off period during which you may rescind the deal

- your old and new suppliers will collaborate to ensure you’re not double charged

- the new supplier issues accurate, timely bills

- you receive the last bill within 6 weeks of the switch, and get reimbursed no later than 14 days after

- suppliers must accept direct debit payments on sign up

As you fill in your preferences, feel free to tell Joules which suppliers you’d like to exclude from the search.

After your first flip, the service will continue to scan the market monthly, and switching you once savings of £50 or more are feasible. They’ll notify you of upcoming switches, but perform them automatically, so you don’t miss out. Remember, you always have 14 days to cancel after Flipper tells you about the switch.

How does Flipper make money?

In contrast to price comparison sites and Look After My Bills, Flipper doesn’t charge a commission fee to the lucky suppliers who get your business. Instead, they bill their customers a £30 annual membership fee. And while this may sound less appealing than the free service, so many other firms offer, keep in mind that this payment structure lets Flipper operate independently. With no reliance on commercial agreements, Flipper can get you tariffs from across the wide market. What’s more, your £30 fee is due only after Flipper has saved you at least 50 quid per year.

What do customers think of Flipper?

With around 30,000 customers, Flipper has a notably smaller share of the switching market than Look After My Bills. That said, their customers seemed satisfied enough to commend the service with an ‘excellent’ Trustpilot score of 4.6 out of 5. 90% of Flipper’s reviews are either ‘great’ or ‘excellent’.

How much would I save with Flipper?

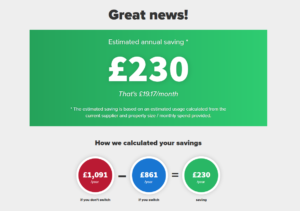

To take Flipper’s money-saving abilities for a test drive, we used the same assumptions as we did with Look After My Bills: London postcode, 12,000 kWh of gas, 2,900 kWh of electricity, EDF’s standard variable tariff. With this as our ‘current deal’, here’s what Flipper found for us:

As you can see, Flipper promises much juicier savings than their free-to-use pals over at Look After My Bills. That’s the power of the wide market.

Pros of Flipper

- access to the entire energy market

- automated, monthly switching

- lots of filters to refine your tariff search

- ‘intelligent’ switching that factors in more than just the rates

- rigorous selection of suppliers, with an emphasis on quality service

Cons of Flipper

- £30 annual membership fee

- the inability to choose your tariff (although you can cancel the one Flipper finds you)

3. Switchd

Like Flipper, Switchd can access every available tariff to find you the best deal. You’ve guessed it, that’s because they don’t work on commission, and you’re right, their service isn’t free. That said, Switchd offers a robust comparison and switching platform, with a range of support options and a smartphone app to sweeten their deal.

How does Switchd work?

Switchd works very similarly to their peers over at Flipper. In fact, the sign-up and ‘survey’ processes are relatively standard among all auto-switchers, so we won’t bore you with it again. In a nutshell, your location, current tariff, and usage are all they need to generate a replacement tariff, at which point you can proceed with the switch and membership enrolment.

Again, just like Flipper, Switchd doesn’t stop working after your first supplier swap. Anytime they find savings over £50, they’ll initiate a new change, as long as the tariff falls within the expectations you’ve specified when you signed up. Switchd notifies you by email before any new tariff change, and you can see all the pertinent details through their dashboard and smartphone app.

How does Switchd make money?

Switchd uses a hybrid business structure. The service offers a free plan, which works much like Look After My Bills. The suppliers who get your business through Switchd pay a commission fee, you pay nothing; the downside here is the limited supplier pool.

If you’re willing to pay £1.99 per month, Switchd will trawl the wide market to pick you the best deal. You still won’t pay a penny until Switchd has saved you £50 per year. With this plan, you’ll receive customer support over chat or email only; if that doesn’t work for you, and you’d rather pay a tad more for phone support, you may opt for Switchd’s ‘standard’ plan, which costs £3.49 per month. And if you want all the bells and whistles – in this case, a dedicated support agent and service over WhatsApp – you’ll have to splurge on their £4.99 p.m. ‘premium’ plan.

What do customers think of Switchd?

Switchd has earned a Trustscore of 4.3 out of 5. And while 87% of the reviews are ‘excellent’ or ‘great’, some customers express concerns over errors that have occurred during the switching process. Such negative feedback is quite rare, but checking out the Switchd page on Trustpilot may be worth your time if you’re thinking about using the service.

How much would I save with Switchd?

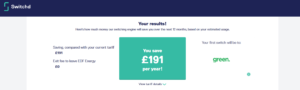

We’ve used all the same parameters as we did with Flipper and Look After My Bills. Here are the savings Switchd dug up:

Pros of using Switchd

- free plan, albeit with a limited range of tariffs

- sizeable savings, thanks to wide market access

- a decent range of customer support options

- frequent switching

Cons of using Switchd

- the free plan offers limited savings

- higher price for plans with phone support

Final thoughts

Even with 50+ energy firms to choose from, millions of Brits still overpay for electricity and gas.

The ‘Big 6′ energy suppliers dominate three-quarters of the energy market, banking on their customers’ aversion to risking a switch. But as we’ve (hopefully) showed you in this post, the advantages of switching outweigh the risks. Your savings could be quite substantial, and there are safeguards in place to ensure that your energy flows uninterrupted, even if your new supplier fails.

And it’s not just us saying that. Ofgem, the energy regulator, and Citizens Advice, a decades-old UK charity both encourage frequent switching as a strategy for keeping your bills low.

The most effortless way to compare and switch your electricity and gas providers is through an automated service, offered by firms like Look After My Bills, Flipper, and Switchd.

Be sure to check out their sites to see how much you can save.

Do you feel that we’ve missed anything? Or do you have a personal experience you’d like to share? If so, our readers and us would love to hear your feedback, so please leave us a comment below!